Stay Up To Date On All Things Croghan Nation!

We love staying connected with our community and sharing helpful resources. Sign up for our quarterly newsletter to get financial tips, updates on new products and services, and the latest happenings at Croghan Colonial Bank!

- 2026

- 2025

- 2024

- 2023

Building Stronger Communities Together

At Croghan, giving back starts close to home. Through Croghan Cares, employees across our offices and departments choose local nonprofits that matter dearly to them, from local food pantries and youth programs to veteran support and health initiatives. Together, we’ve supported organizations across Sandusky, Erie, Huron, Seneca, Lucas, Ottawa, and Cuyahoga counties, showing up where our neighbors need us most.

Understanding Wills and Trusts

Estate planning is one of the most important ways to care for the people you love. Understanding the difference between wills and trusts — and how they work together — can help reduce stress and provide clarity for the future. Learn how Croghan’s Trust & Investment team can help you create a plan that reflects your goals and priorities.

Plan Ahead for Moments That Matter

Life doesn’t slow down, and big milestones often arrive sooner than expected. From weddings and moves, to college planning and new opportunities, thoughtful preparation can make each step feel more manageable. Our team is here to help you plan ahead with confidence for whatever the new year brings.

Celebrate the Season at Rock & Awe

The holidays shine brighter in Fremont! Join us for Rock & Awe, a dazzling light show at the Courthouse.

Protect Yourself from Holiday Scams

Scammers love the holidays. Here’s how to stay one step ahead.

Plan Ahead for Holiday Spending

The holidays bring joy, but also big expenses. A plan helps you celebrate without financial stress.

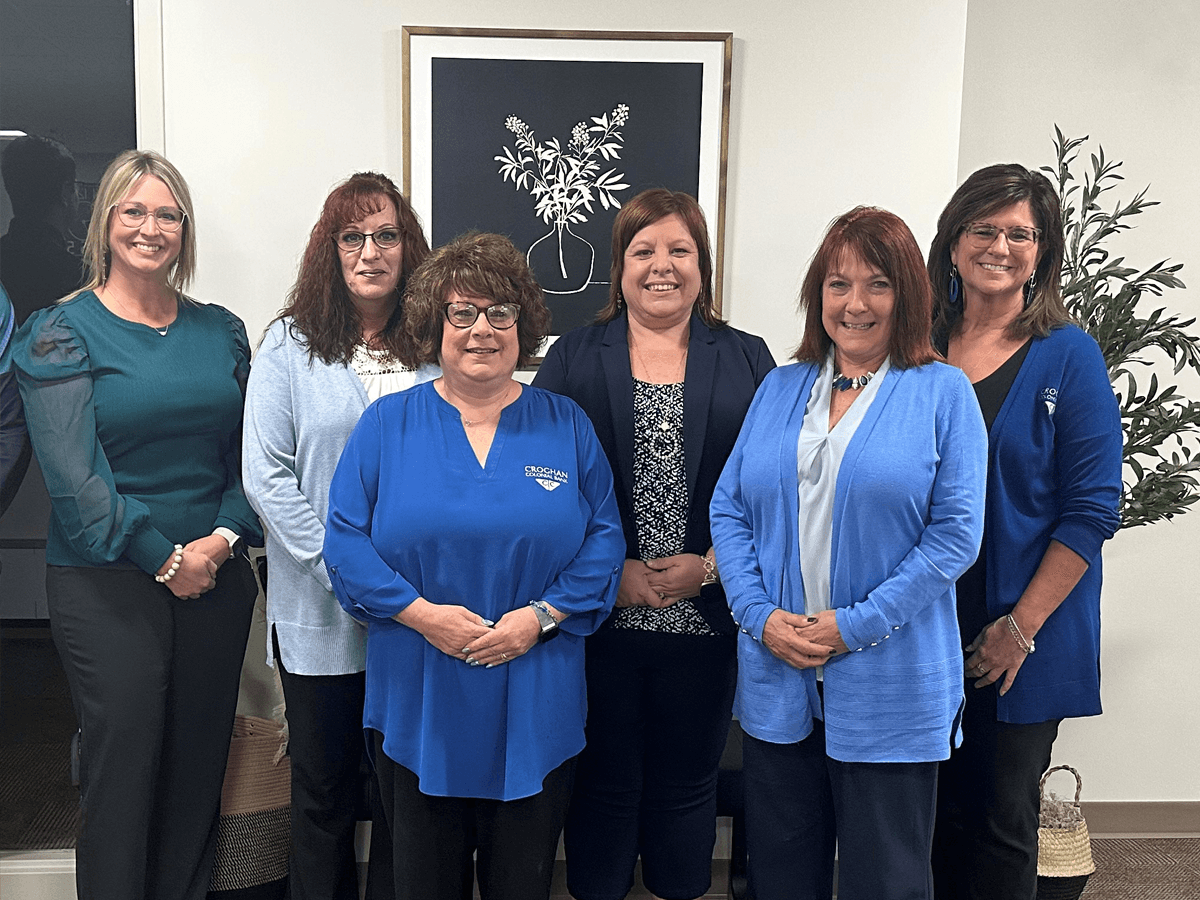

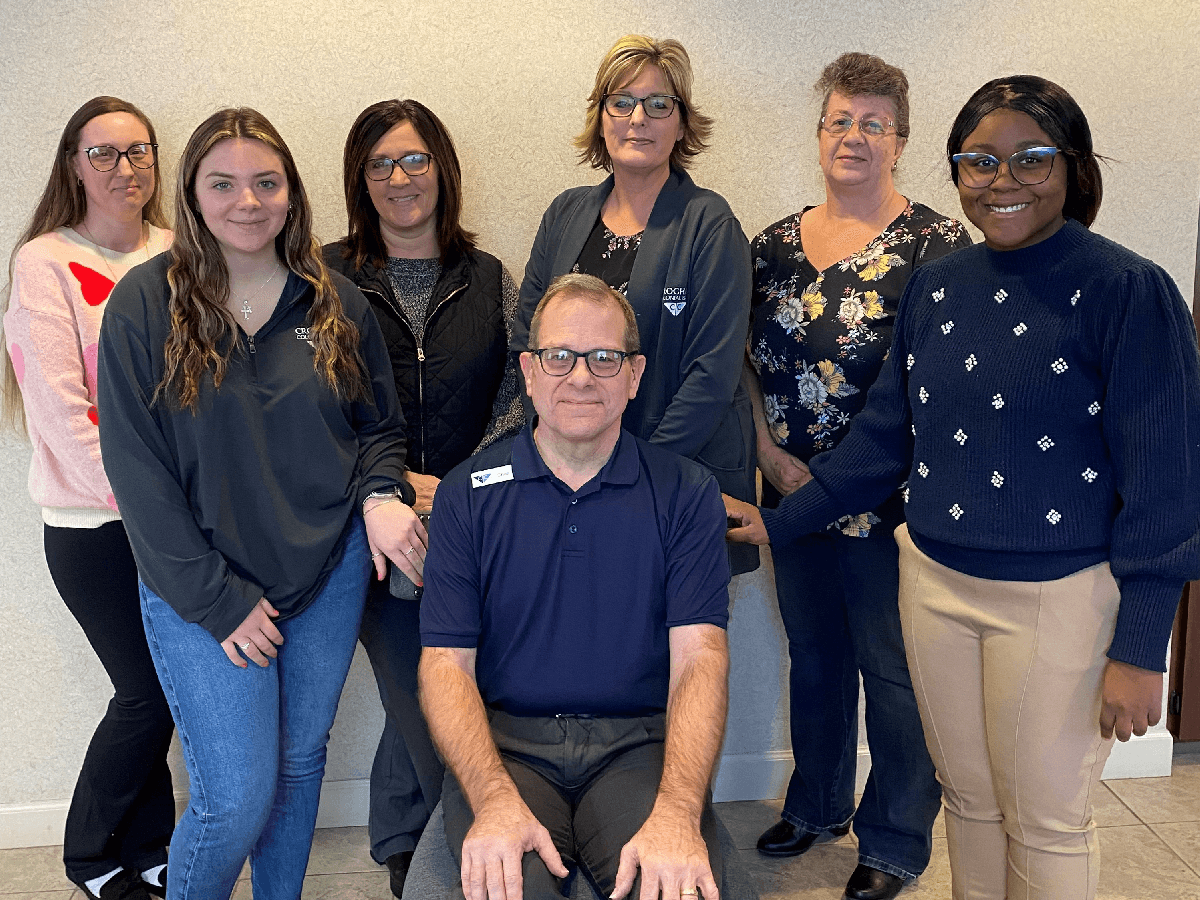

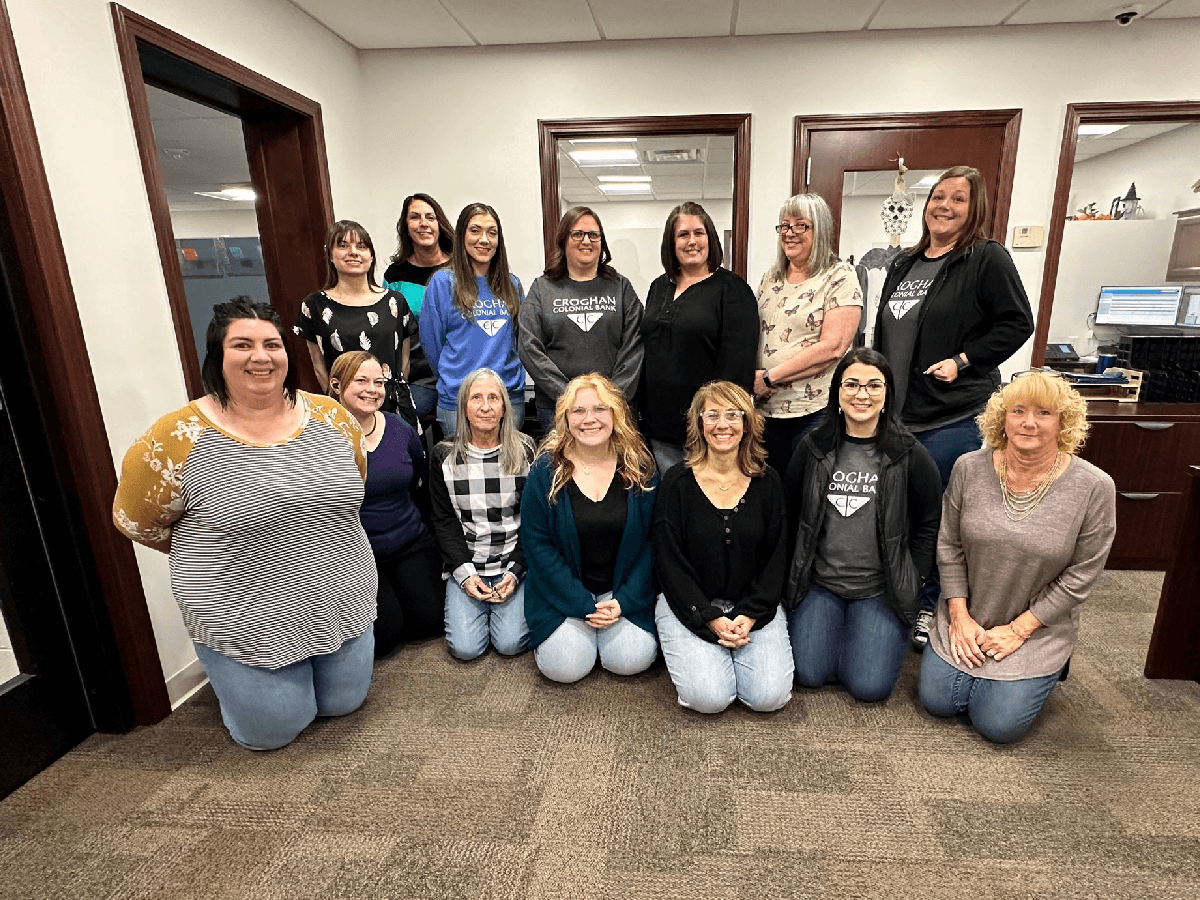

Department Spotlight: Your Retail Banking Team

Meet our Retail Team! This team loves being out in the community and building relationships with customers. They’ve dedicated a combined 188 years to Croghan Colonial Bank!

Common Questions: Fall Financial Planning

Smart answers to help you prepare for year-end and beyond.

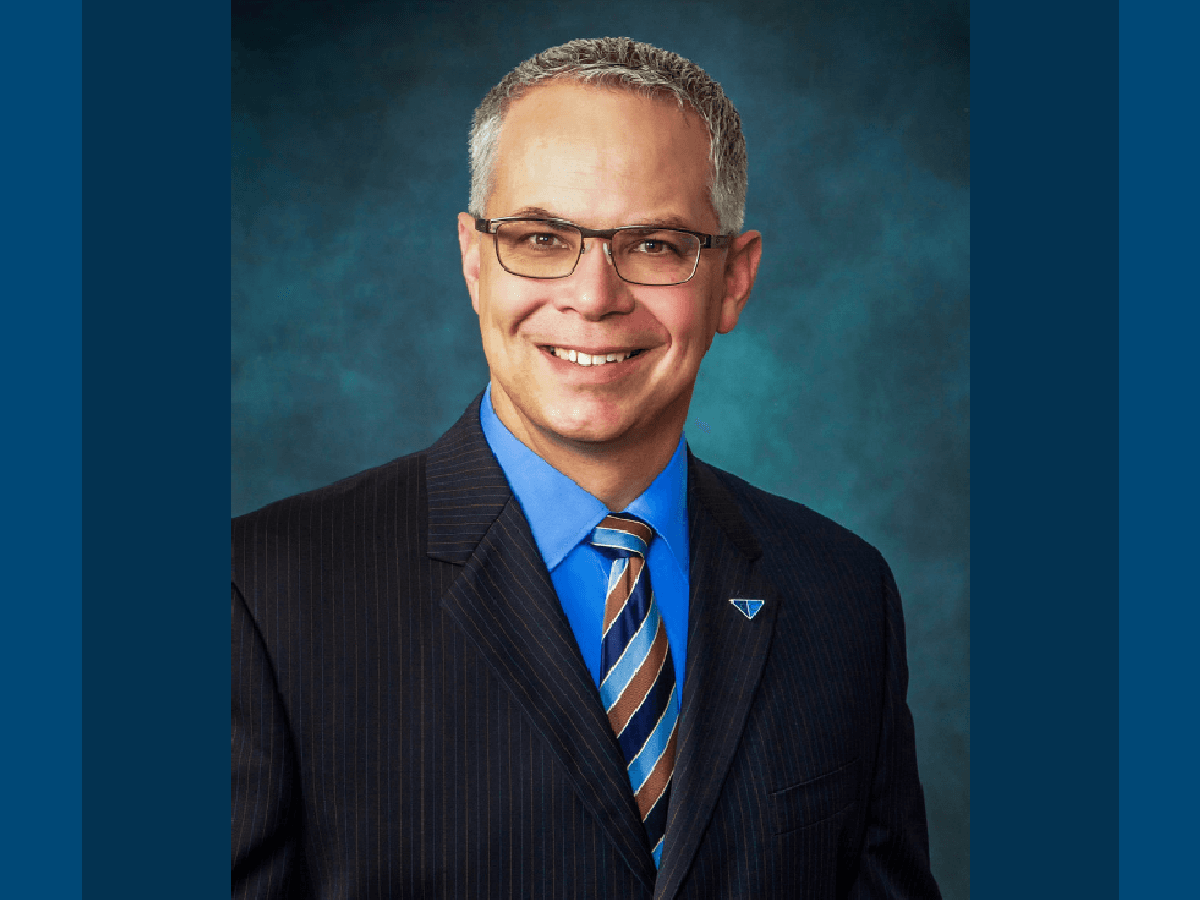

New Technology Updates Coming

“We’re excited to announce that we’re implementing significant technology updates to better serve our clients’ banking needs,” says Kendall Rieman, President/CEO.

Teaching Kids About Money: Start Strong, Start Early

It’s never too early to help children develop healthy financial habits. Teaching them how to earn, save, and spend wisely builds confidence and prepares them for financial success.

How to Recover Financially After Summer Vacation

Summer fun is worth every memory, but sometimes it stretches your budget more than expected. Now is a great time to regroup and reset your financial plan for fall.

Navigating Inflation: Smart Strategies to Stay Ahead

From grocery bills to utility costs, inflation continues to impact households. While you can’t control the market, you can control your strategy.

Debt Management Tips

Discover practical strategies to reduce debt, stay on track, and improve your financial health—starting now.

Making the Most of Your Tax Return

David Theiss, VP, Senior Wealth Management Advisor & Financial Planner, shares how to turn your refund into long-term financial growth through savings, investments, or retirement contributions.

Mortgage Department

Buying, building, or refinancing? Get to know the experts who make home financing easier—every step of the way.

Ways to Improve Your Credit Score

From paying bills on time to reducing balances, here are smart, actionable ways to improve your credit score.

Understanding Cash Out Refinancing

Learn how this option can help you tap into your home’s equity for major expenses, debt consolidation, or long-term goals.

Tax Planning: Key Strategies for 2025

David Theiss, Croghan’s VP, Senior Wealth Management Advisor, shares valuable tips to help you prepare for tax season.

Debt, Consider a HELOC

Take advantage of our Home Equity Line of Credit (HELOC) promotion to consolidate debt, fund vacations, or manage other big expenses. Learn how you can lock in a rate today!

Kendall Rieman Joins the Board of the Federal Reserve Bank of Cleveland

We’re proud to announce Kendall Rieman’s election to the Federal Reserve Bank of Cleveland’s Board of Directors. Read more about this honor and his new role.

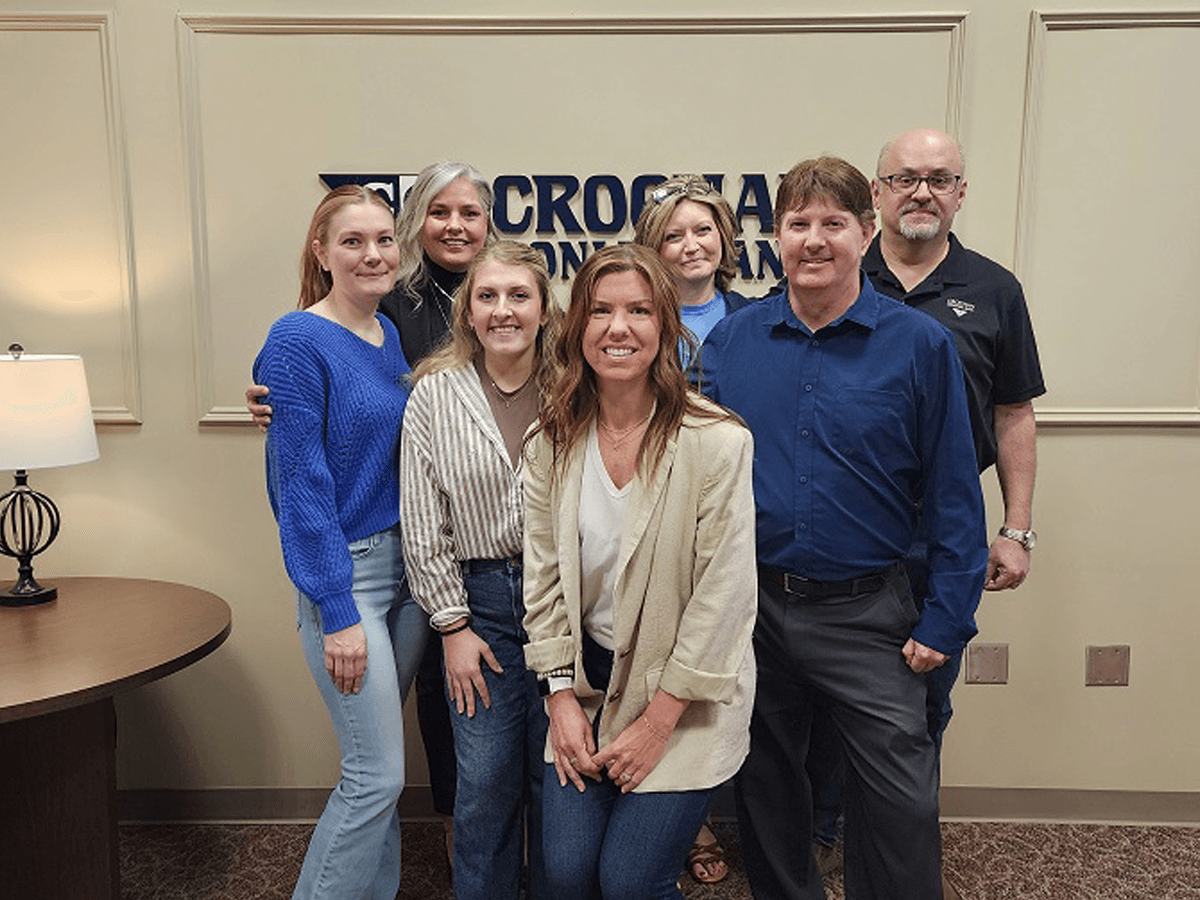

Location Spotlight: Fremont Main Office

Croghan’s Main Office in Fremont has been serving the community since 1888. Meet the dedicated team behind this cornerstone of service.

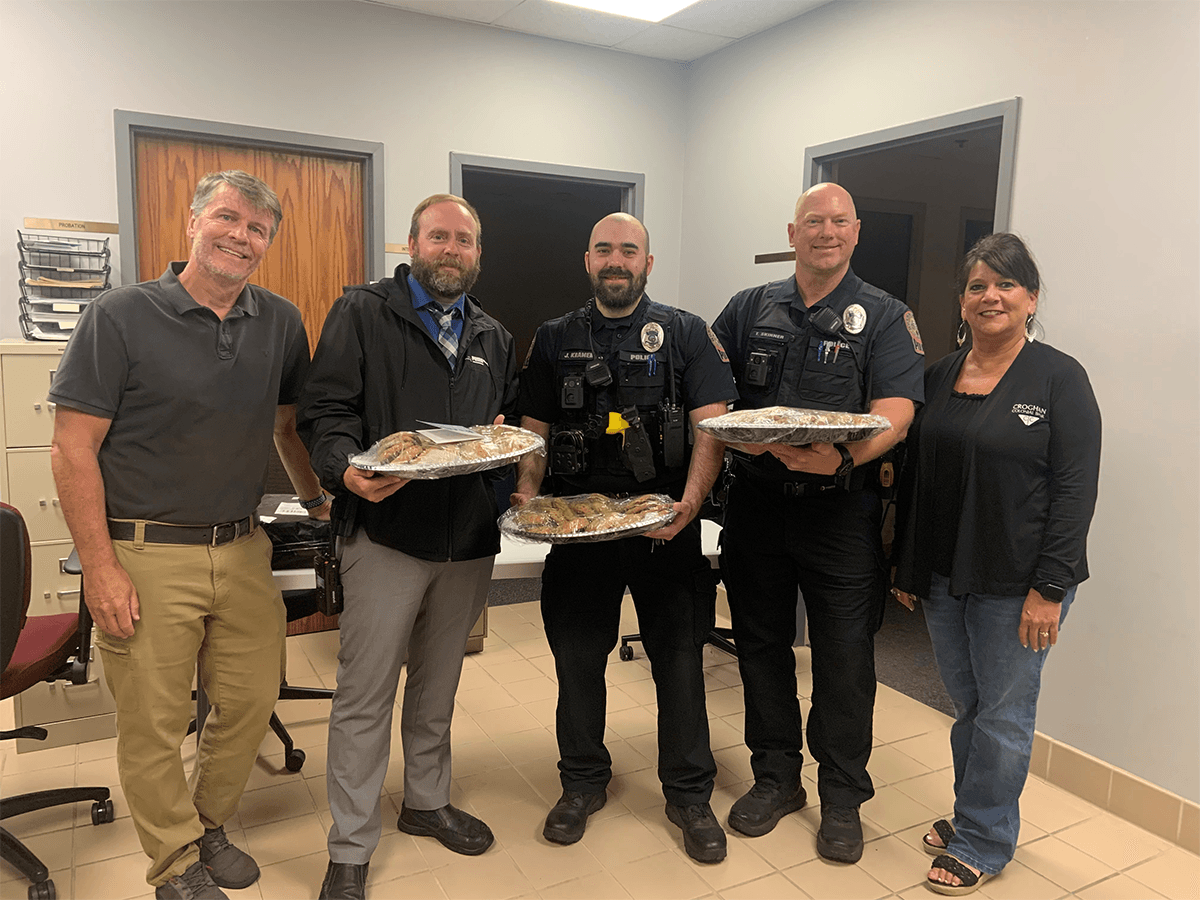

Croghan Cares: Giving Back to Our Communities

Through our Croghan Cares initiative, we proudly support local nonprofits. Learn how we’re making a difference with donations hand-delivered by our team.

Celebrating the 2023/2024 CC and SME Awards

Croghan is proud to recognize the dedication and excellence of our 2023/2024 CC and SME Award winners. Meet the standout employees driving our success!

Beware of Invoice Scams: Tips to Stay Safe

Scammers are increasingly targeting individuals through fake invoices. Learn key tips from Croghan’s security team on how to spot and avoid these scams.

Financial Planning for the New Year

The new year is a great time to review your financial goals. Croghan’s experts can help you with savings, debt management, and planning for life’s milestones.

Budgeting for the Holidays: Start Saving Today

Get ahead of holiday expenses with Croghan’s Holiday Savings Account—a simple, effective way to save for gifts, travel, and celebrations year-round.

Meet the Human Resources Department

Behind every successful hire and employee experience is our HR Department. Learn more about the team supporting Croghan employees and their contributions to our community.

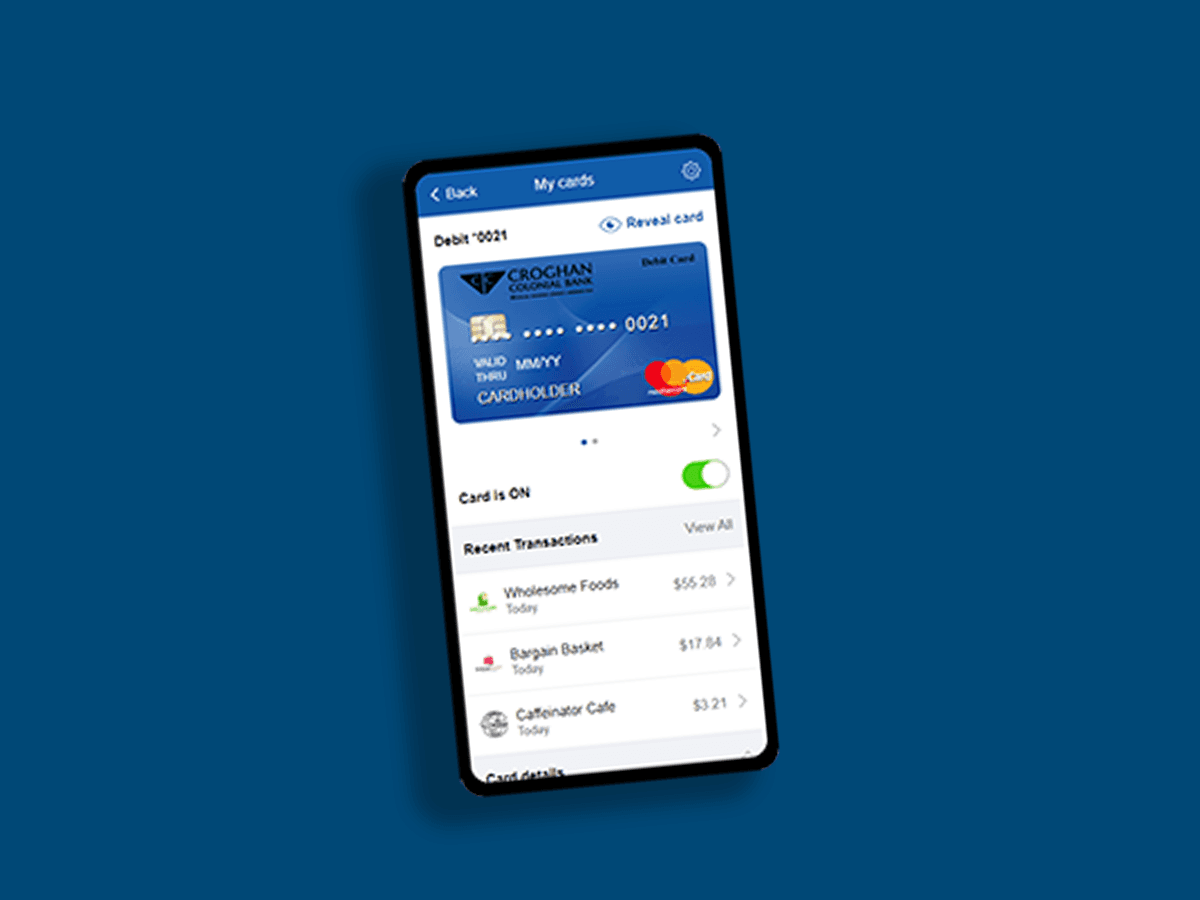

Digital Wallets and Debit Card Utilization

Digital wallets allow you to pay on the go, using your Croghan Debit Card, so you can make purchases with the tap of your phone.

How Changing Interest Rates May Affect Your Finances

Interest rates can affect your investments, budget, and lending options. Check out our Wealth Management Teams insights on managing your wealth during interest fluctuations.

Meet the Deposit Operations Team

Behind every bank transaction is our Deposit Operation Department. Get to know the team.

Guiding Children Along their Financial Journey

Smart money habits acquired early on can help children and young adults develop lifelong financial responsibility. That’s why we have a $uite of products to help you help your children along their financial journey.

How Your Credit Score Can Impact Mortgage Options

A good credit score can open up many lending opportunities when you want to finance a home purchase. Read our article to learn how to make the most of yours.

Credit Card Dos and Don’ts

Paying your credit card bill on time is an effective way to maintain a good credit score. This article has more tips for good practices and advice for behaviors to avoid.

Five Tips for Protecting Yourself from Fraud

Unfortunately, fraud is common. Learn about different types of fraud and what you can do to protect your financial information.

Meet the Oak Harbor Team

Personalized services and financial solutions are the Oak Harbor team’s specialties. Check out some fun facts about each member of this amazing team.

It’s Time to Get Ready for Boating Season

That means it’s time to start thinking about your options for purchasing a boat so you can be out on the water!

The Importance of Financial Literacy for All Ages

Understanding your current financial picture and determining the steps to plan for your future is essential.

What Makes Croghan a “Community” Bank?

We’re not just a financial institution. We’re a part of the towns we serve. We send our kids to the same schools and attend the same community functions as our customers. Our employees always give their time by volunteering and participating in local non-profits.

Celebrating Our Employees’ Years of Service

From a few years to decades of service, we’re thankful for our employees who work diligently for the Croghan nation! Check out the complete list of 2023 anniversaries.

Croghan Cares: Giving Back to Our Communities

Helping our communities is one of the pillars upon which Croghan Colonial Bank was founded. Croghan Cares is our company’s charitable initiative that provides donations to local nonprofits to support their causes.

Plan Your Financial Success in the New Year

The new year is the perfect time to get organized and brainstorm ideas to improve your finances.

Interested in Investing? Consider Bonds

Bonds, or fixed-income investments, provide competitive returns that are more reliable than the stock market. You may benefit from investing in bonds if you have an established nest egg and want to grow it reasonably.

Celebrating the Subject Matter Experts and Croghan Commendation Award Winners

The Subject Matter Experts (SME) and Croghan Commendation (CC) Awards were created as a way for employees to be recognized for their hard work and expertise.

Product Spotlight: Holiday Savings Account

Allocate funds for the holidays or something special so you have plenty to spend when it’s time to shop or travel. A Croghan Holiday Savings Account only requires $20 to open and collects interest throughout the year.

Banking On Your Terms and On Your Time

Mobile banking allows you to monitor account activity and make deposits right from your phone. You can coordinate monthly payments for utility bills, credit cards and other expenses with Croghan’s bill pay service. That way you never have to wonder if your expenses will be paid on time.

Beyond a Piggy Bank: The Importance of Youth Financial Education

Educating younger generations on managing personal finances is essential, whether you have a college student planning for a new semester or a grade-schooler learning to budget their allowance.

Find Out Why People Love Croghan Colonial Bank

We’re proud to be a local bank that offers personal and business banking services. We could sing our praises all day but don’t take our word for it. Read what some of our customers had to say about Croghan!

Supporting Our Communities

Croghan recently celebrated its 135th anniversary, and we’re proud to say we’ve spent more than 100 years supporting the people and organizations around our Croghan office communities.

What’s New at Croghan?

Learn more about the newest exciting things happening at Croghan Colonial Bank!

Get Answers Quickly with Croghan’s New Chat Service

We recently launched a chat service here on our website. This service lets you contact a Croghan customer service specialist during regular banking hours.

Advantages of a Low-Down Payment Mortgage

The housing market continues to change rapidly, but that doesn’t mean you have to put your dream house on hold to avoid breaking the bank.

Get Your Financials in Order Before Vacation

With the Croghan app, you can review transactions, check balances, transfer funds between Croghan accounts, and make loan payments without additional service costs. You can also freeze and unfreeze your debit card if you misplace it while traveling.

Tips for Protecting Yourself from Personal Fraud and Scams

Unfortunately, financial fraud is common. There are almost 300 different types of fraud, and anyone is susceptible. That’s why learning how to protect your identity and assets is essential.

Education Resource: Navigating Inflation

Inflation may be a regular part of a healthy economy, but it still affects prices, the value of a dollar, and your budget. So, we’re committed to providing you with the financial education resources you need to navigate the current economy.

We’re Proud of Our Employees

Anniversaries are essential at Croghan Colonial Bank, and we want to recognize the staff who have dedicated years of service to Croghan Nation. Several employees reached milestone anniversaries in 2022.

Are You Ready for Tax Season?

You’ll need to get organized during tax season. That means going through your records, statements, and paperwork to ensure you have as much information as possible for your tax advisor. Giving them a detailed look into your finances will help them get you the most on your tax returns.

5 Tips to Help You Reach Your 2023 Financial Goals

It’s essential to check your credit score for inaccuracies and improvements periodically. You can improve your credit score by paying bills and loans on time, reducing your credit card balance, and making sure there aren’t outdated debts affecting it.

Education Resources: Buying a Home

Are you considering buying a home but don’t know where to start? Croghan Colonial Bank offers information and resources to help you make educated decisions.

What’s on the App?

Card Management is at your fingertips with the Croghan Mobile Banking App. Tracking your card activity can be done with the touch of a button, and you can easily monitor your transactions and spending activity.