- Home

- Resources

- Five in Five

Five in Five

Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

February 2026

This month’s Five in Five covers the following topics:

- Softer Labor Markets = Lower Wage Pressures (Inflation)

- Manufacturing Data Improves

- Corporate Bonds

- Relative Cumulative Performance of the Magnificent 7 to the Eurozone “GRANOLAS”

- U.S. Large-Cap vs. Foreign Developed – Relative Performance and Valuation

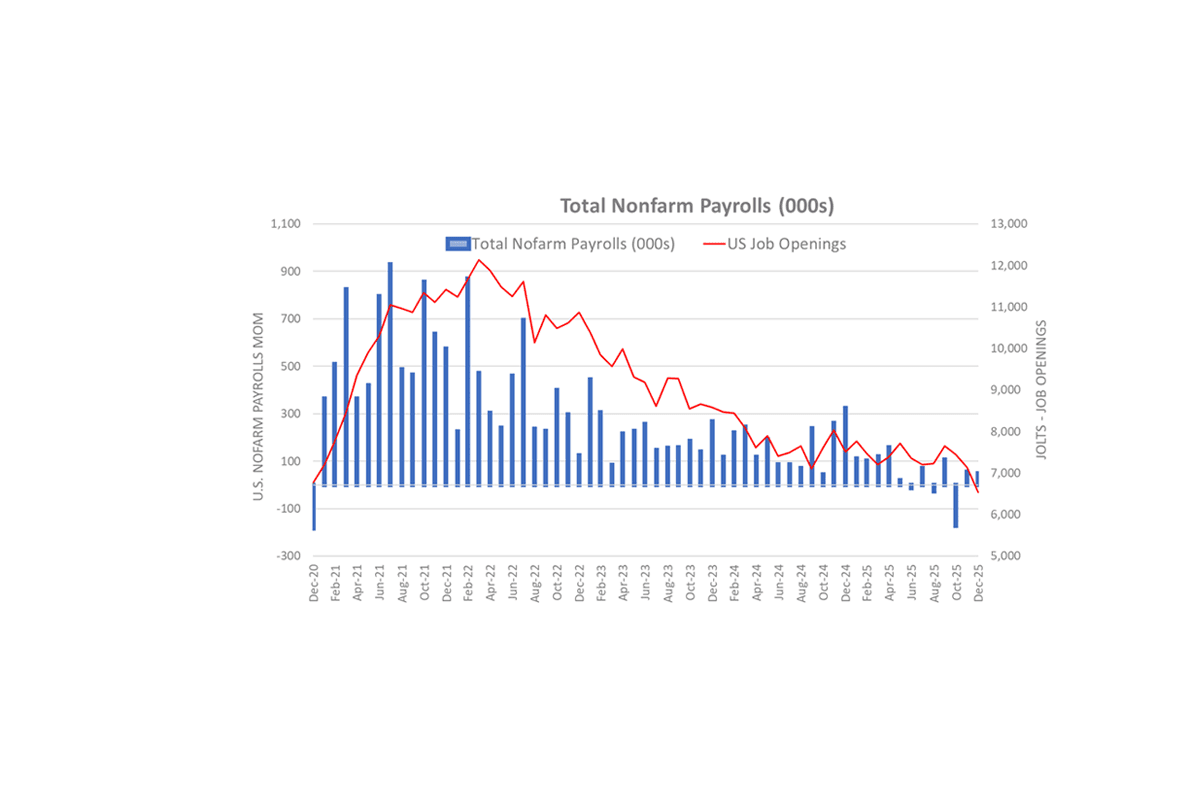

Softer Labor Markets = Lower Wage Pressures (Inflation)

- Nonfarm Payroll (NFP) figures serve to measure monthly job creation and overall economic health.

- Slowing job creation appears to have finally stabilized, but increased job cuts risk further decline.

- Steep decline in December job openings adds evidence of softening labor demand.

- Latest data signals to Fed that wage pressures not a likely source of inflation ahead.

- Nonfarm payrolls for 2026 are expected to stay below 80,000 per month, almost stall speed.

Source: Bureau of Labor Statistics

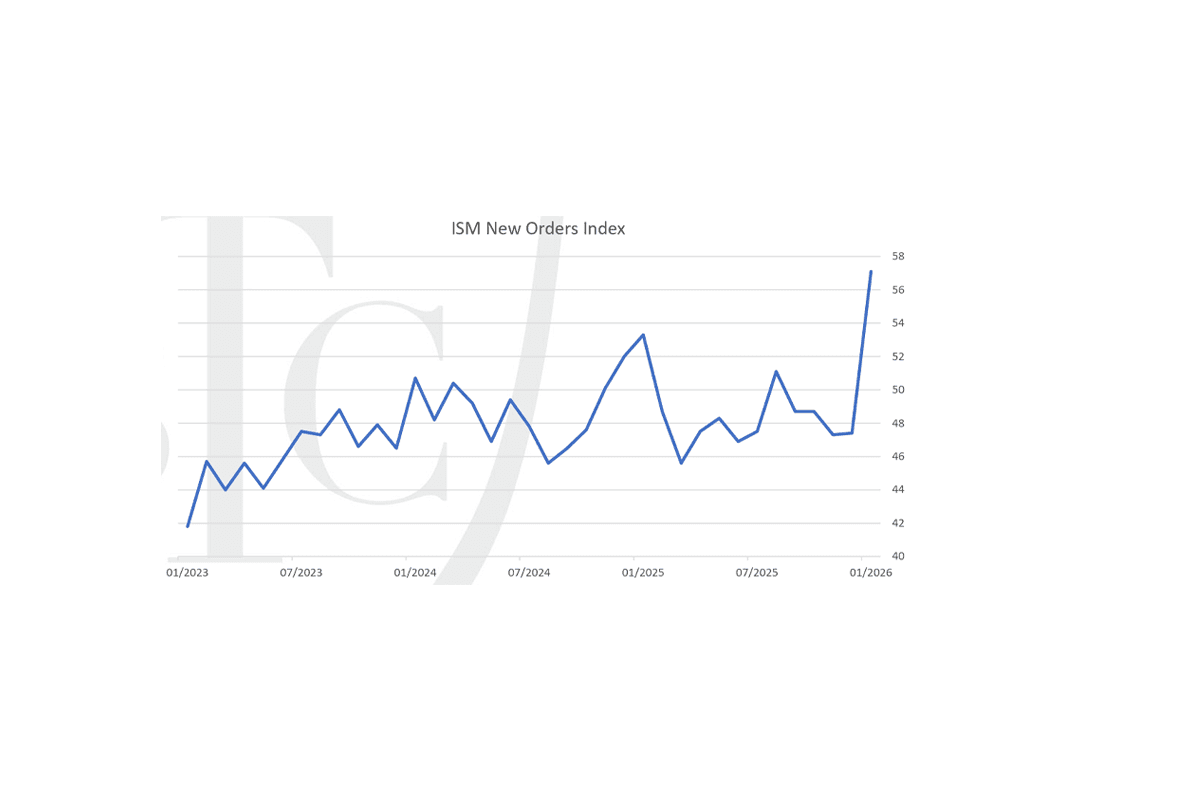

Manufacturing Data Improves

- ISM Manufacturing New Orders Index hits three-year high. 01/2025 07/2025

- This index is part of Conference Board Leading Economic Index, which is showing improvement.

- Offers a counterbalance to weak employment data.

- Several cyclical equity indices were already in well established uptrends prior to the data release.

- Might hint at calendar 2026 GDP coming in better than relatively low consensus expectations.

Sources: Bloomberg

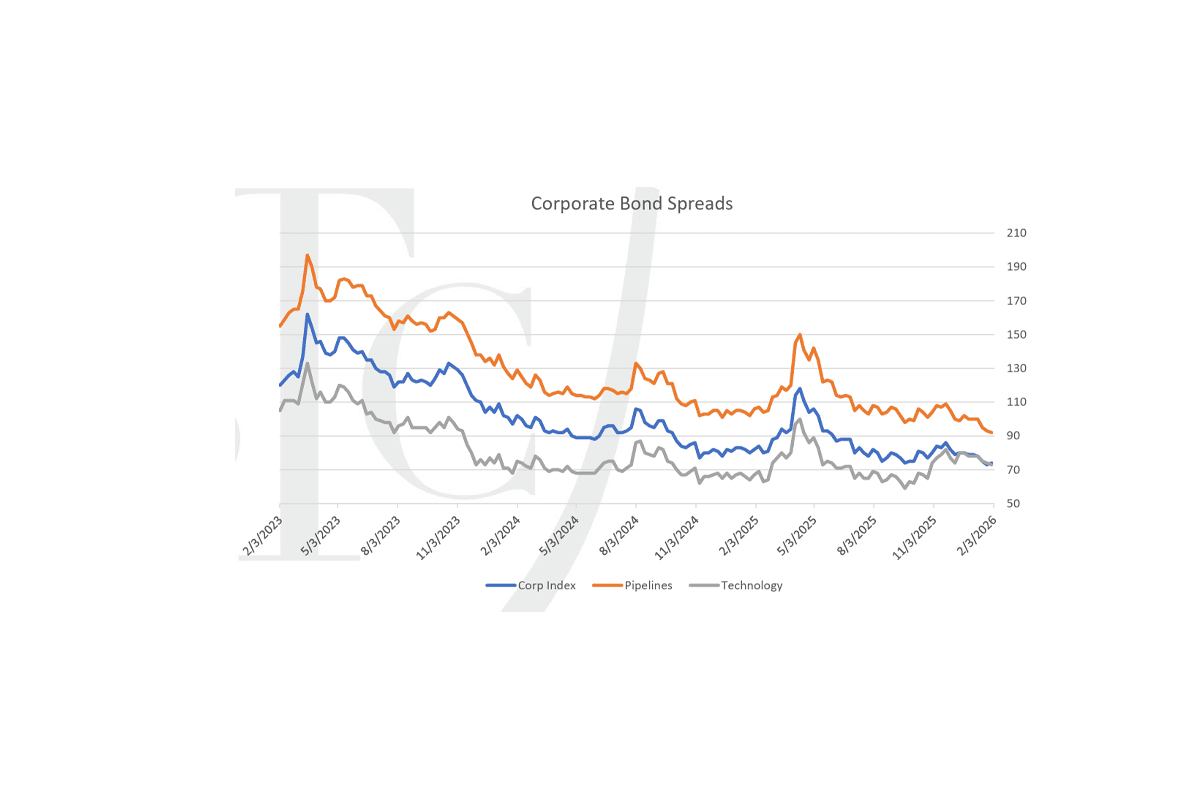

Corporate Bonds

- Corporate bond spreads remain near lows despite some industry headwinds.

- Technology spreads have widened out in recent months given large capex requirements.

- Pipelines show the best momentum in the absence of a strong oil price market.

- Several single-names and industries’ spreads widened on AI headlines.

- Industries that are AI-resistant may become a bigger source of investor capital.

Sources: Bloomberg

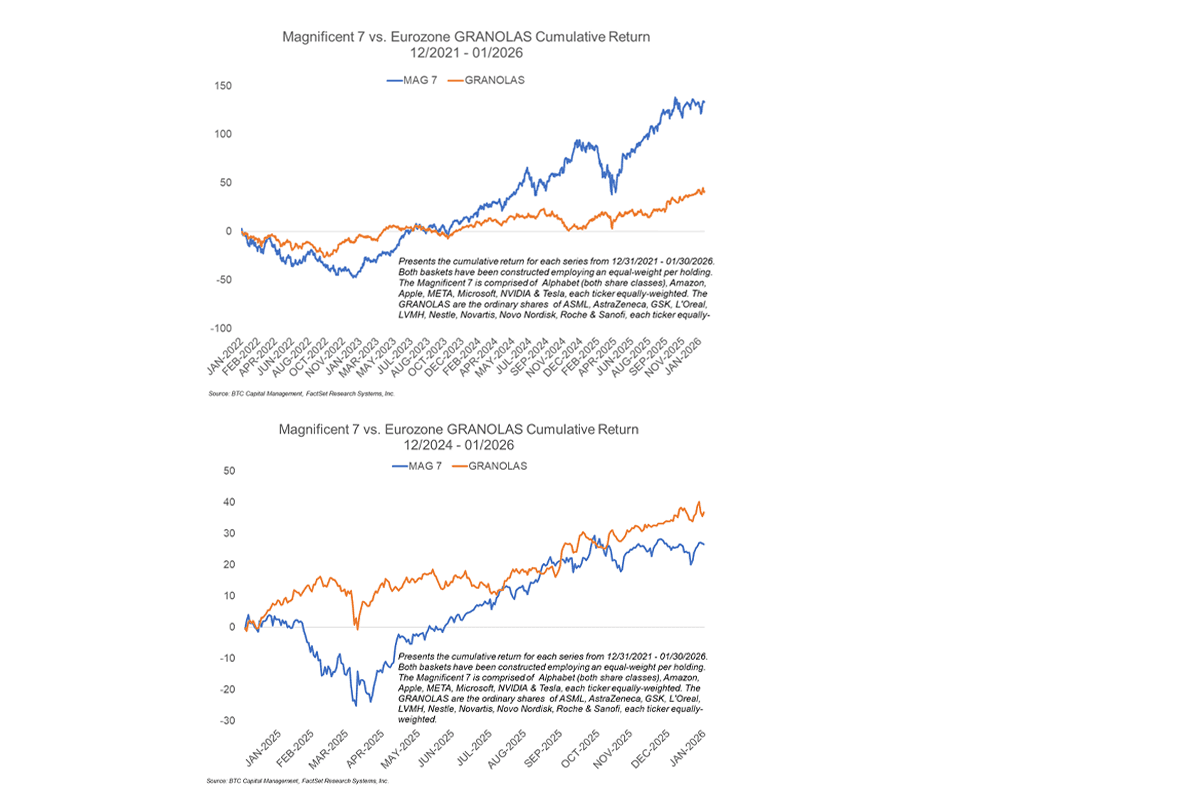

Relative Cumulative Performance of the Magnificent 7 to the Eurozone “GRANOLAS”

- Each chart presents the cumulative return of the Magnificent 7 (MAG 7) versus that of the GRANOLAS. Each series is a basket of equally-weighted tickers of the companies comprising each series.

- The MAG 7 is constructed of the following companies: Alphabet (both share classes), Amazon, Apple, META, Microsoft, NVIDIA and Tesla. Note this series is concentrated within the following sectors: Communication Services, Consumer Discretionary and Information Technology.

- GRANOLAS is comprised of the ordinary shares of the following European companies: ASML, AstraZeneca, GSK, L’Oreal, LVMH, Nestle, Novartis, Novo Nordisk, Roshe and Sanofi. Note this series is concentrated within the following sectors: Consumer Discretionary, Consumer Staples, Healthcare and Information Technology.

- MAG 7 has outperformed since 2021 (left-hand chart), driven by factors such as growth, size and momentum.

- Given relative valuation coupled with the waning momentum trade, GRANOLAS has outperformed the MAG 7 since 12/31/2024 (right-hand chart).

Source: BTC Capital Management, Factset Research Systems, Inc.

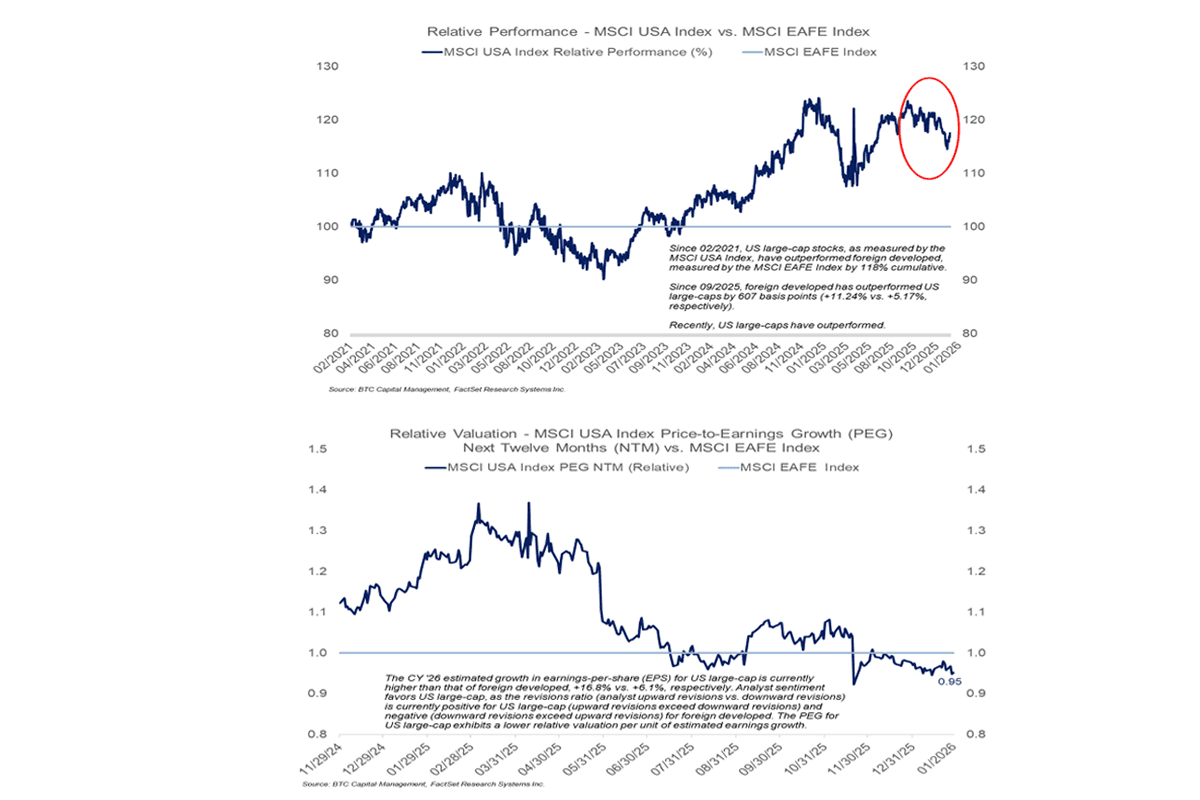

U.S. Large-Cap vs. Foreign Developed – Relative Performance and Valuation

- Since 2021, U.S. large-cap, as measured by the MSCI USA Index, handily outperformed foreign developed, as measured by the MSCI EAFE Index. Since September ‘25 foreign developed has outperformed U.S. large-caps.

- Valuation has been a concern regarding U.S. large-cap, which has been a headwind to relative performance. While analysts project year-over-year (YOY) earnings growth of 16.8% for U.S. large-cap for CY ‘26, investors have been wary of bidding share prices higher even in the face of attractive earnings growth projections.

- That is not the case with foreign developed, as investors have rotated into this asset-class. The recent outperformance of foreign developed has been attributed to P/E expansion, as analysts project YOY earnings growth of 6.1% for CY ‘26.

- When considering valuation, U.S. large-cap appears attractive relative to foreign developed, given its Price-to-Earnings Growth ratio (PEG) which, at 0.95, is lower than that of foreign developed.

- One may question the sustainability of continued P/E expansion driving foreign developed, especially given that analyst downward revisions of earnings growth currently outpace upward revisions.

Source: BTC Capital Management, Factset Research Systems, Inc.

Important Disclosures

Sources: BTC Capital Management, Bloomberg, Bureau of Labor Statistics, FactSet Research Systems Inc.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations, and you should not interpret any statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.