SBA Loans

Securing financing can be challenging, but SBA loans offer government-backed solutions for businesses with limited resources. These loans provide capital for real estate, equipment, and other needs with longer repayment terms and flexible requirements.

SBA Loan Benefits

Government-backed loans offer advantages that traditional loans may not, including:

Longer Repayment Terms

Manageable payments to support cash flow.

Competitive Interest Rates

Fixed and lower rates compared to conventional loans.

Flexible Uses

Fund real estate, equipment, working capital, and business expansions.

Lower Down Payment

Preserve capital while growing your business.

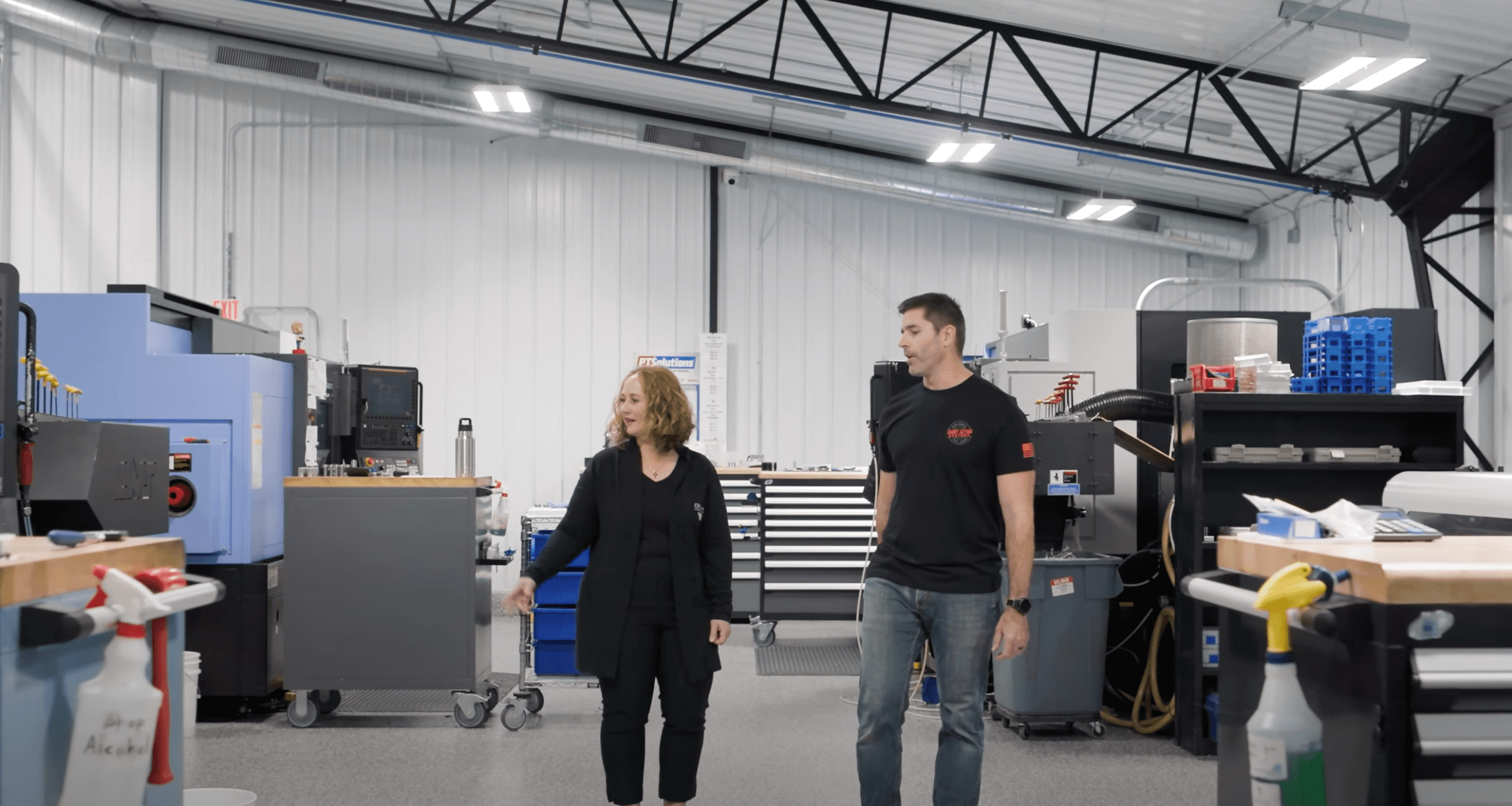

What Makes Croghan Different?

At Croghan Colonial Bank, we understand the unique challenges small businesses face. Our team goes beyond simply offering loans—we build relationships. We take the time to understand your business, so we can recommend the best financial solutions to support your growth, even in tight markets.

VP, Toledo Market Manager & Senior Lender Shannon George explains: “Our lenders are committed to being highly responsive and hands-on, providing personalized support to every business customer, no matter their size or financial strength.”

Our experienced commercial lenders are here to help you navigate the SBA loan process, ensuring you get the support you need to achieve your goals.

Take the Next Step with an SBA Loan

If you’re ready to explore your SBA loan options, contact Valerie Bumb, VP, Commercial Loan Officer. Our team will guide you through the process and help you find the best financing solution for your business needs.

Important Legal Disclosures

*All loans are subject to credit approval.