Small Business, Community Bank Invest in Each Other

In the early 1980s, Tom Hedrick of Monroeville spent his spare time tinkering with performance diesel pulling-tractor parts with Ralph Hedrick and Jim Ebert. By 1985, he had progressed far beyond tinkering and incorporated as a side business. Then, a customer at Tom’s day job needed a machine to extract plastic components from its molding machine. When Tom’s employer was too busy to design and build the required machine, an agreement was made for Tom to build it in his shop in the evenings.

“But, honestly, one of the last worries I have is if I’m going to have enough money to get a job kicked off…If I need new equipment to start a job, I know it isn’t going to be a difficult process, and that lets me be more aggressive in the marketplace.”

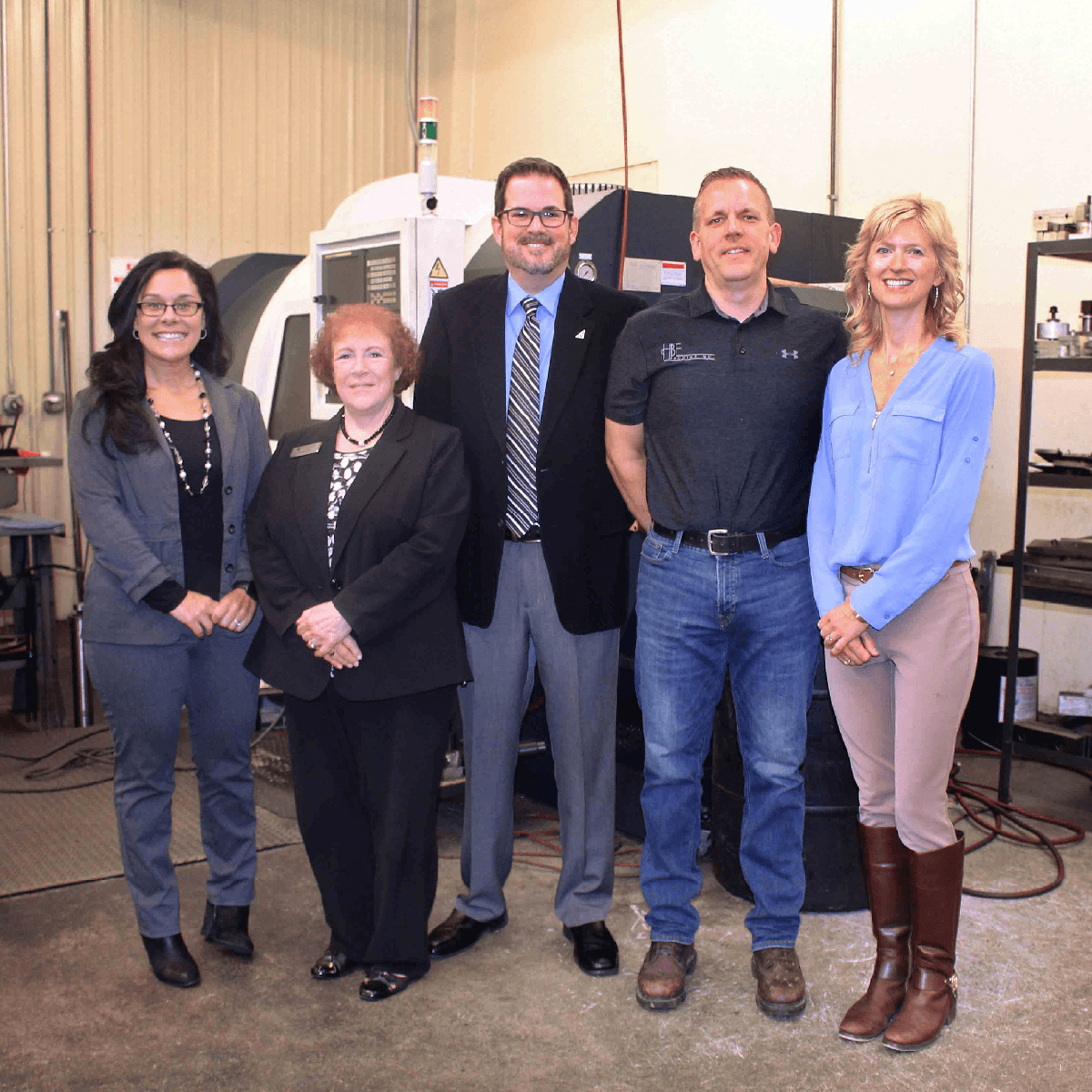

Thomas Hedrick, owner and manager of HBE Machine

That project helped launch HBE Machine. Tom and his wife, Susan, along with Tom’s brother, Ralph, and Ralph’s wife, Karen, poured everything they had into making it work. In 1992, with some help from Croghan Colonial Bank, Tom and Ralph were able to make HBE Machine their full-time employment.

“This is the only bank my dad has ever dealt with,” said Thomas Hedrick, Tom’s son, and current HBE owner/manager. “When he first got married, all of his banking, including home and auto loans, was done at Croghan. When he went into business, he stayed with Croghan, and we’ve been there ever since.”

As HBE expanded its services, Croghan was there to provide support. Now, HBE Machine builds machining components for four primary industries: plastics, performance diesel parts, road construction, and specialty lighting. And through the years and the changes and the next generation, HBE Machine still works with just one bank: Croghan.

Thomas credits the bank’s dedicated service and sense of partnership. For instance, when Thomas took over the business after his father passed away, Croghan guided him through the transition. Though he had been involved with the business for years, he hadn’t been involved in its finances.

“Croghan took the time to explain everything to us and set us up with a credit card machine, electronic banking, et cetera. They came out several times to help us,” he said.

That appreciation goes both ways. Croghan employee said, “We can sit and talk about what HBE Machine has coming up or what Croghan has that’s new. They take the time to really listen and keep our service offerings in the back of their mind.”

During the 2008 recession, HBE’s customers were taking longer to pay, and fewer jobs were coming in. Croghan stepped in to help. Croghan offered a capital loan and a line of credit to bridge the gap, drastically minimizing the impact of layoffs and allowing HBE to invest in new work as the economy recovered. That line of credit is still helping HBE to be agile and competitive.

“You have enough worries about everything you’re doing,” Thomas said. “I like working with smaller businesses. In bigger companies, it’s hard to reach a real person. But with Croghan, they’re always readily available.” That, he said, makes all the difference.

“One thing I’ve always liked and appreciated is that we’re a smaller business, but we’re not just a number to them. We feel important.”