- Home

- Resources

- Market Insights

The Latest Market Insights

October 2025

Global Equity Markets

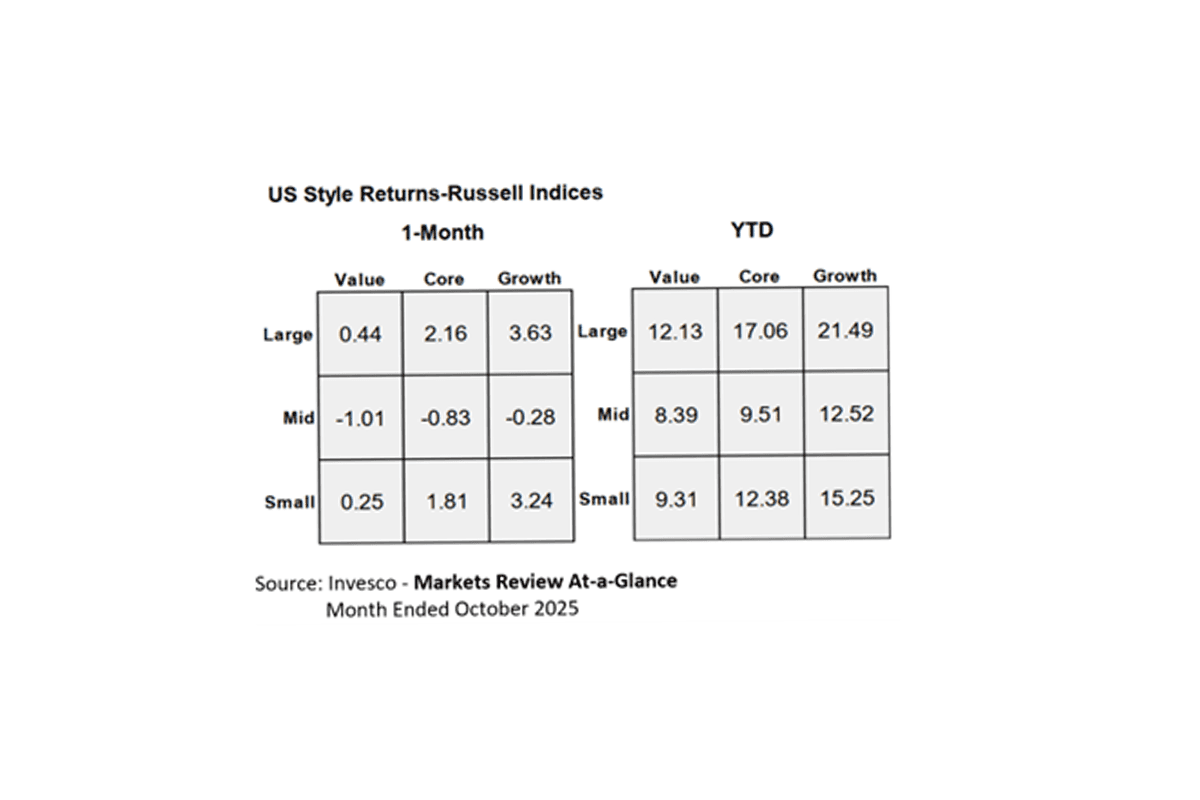

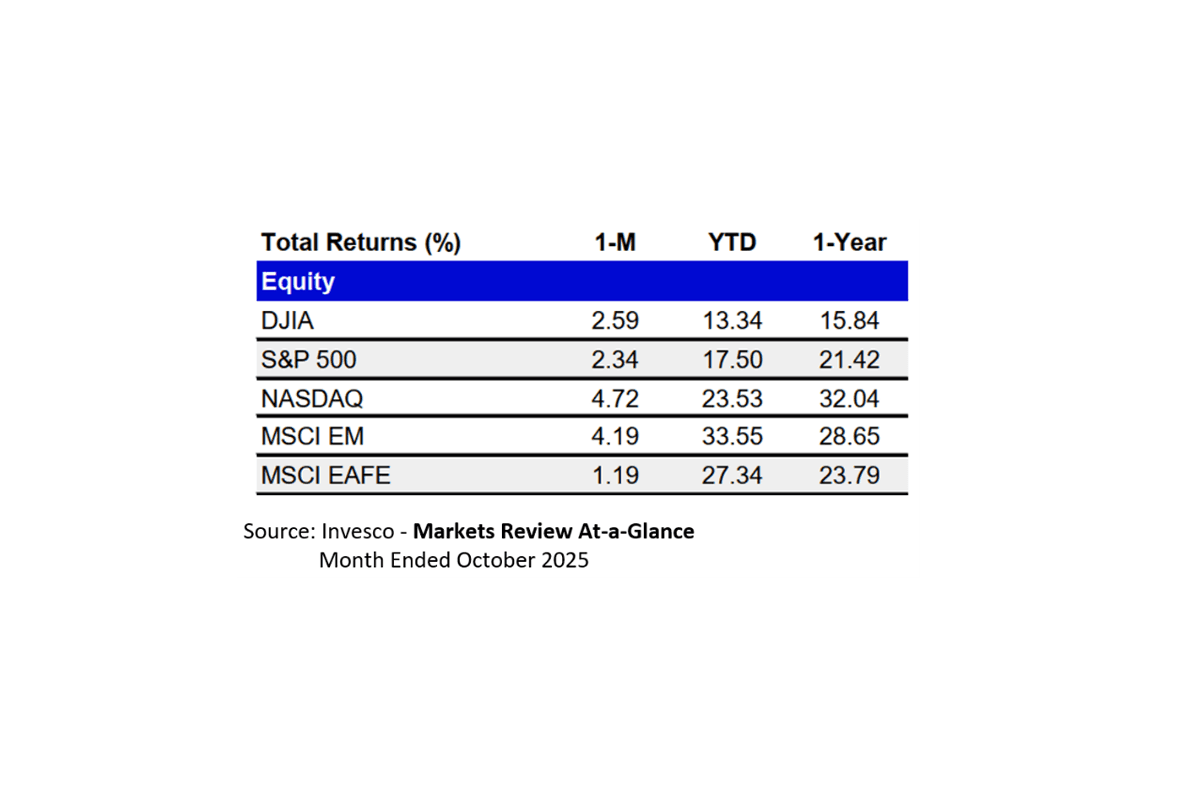

Global equity markets advanced in October, with the S&P 500 rising approximately 2.3%, driven by continued enthusiasm for artificial intelligence, strong corporate earnings, and expectations of monetary easing. The Nasdaq outperformed, gaining nearly 4.7%, while the Dow Jones Industrial Average posted a gain of 2.6%. Sector rotation broadened, with cyclicals and value stocks participating alongside technology. The stock markets experienced diverging returns with the large stocks and small stocks performing better than medium capitalization names. Growth continued to dominate during the month.

International Markets

International markets were also positive with Emerging markets performing almost as well as the domestic tech-oriented Nasdaq. South Korea continued to dominate with its market up ~15% for the month and ~90% YTD.

U.S. Federal Reserve

The U.S. Federal Reserve cut interest rates by 25 basis points, bringing the federal funds target range to 3.75–4.00%. The Fed also announced an end to balance sheet reduction by December. The ECB held rates steady, while other central banks, including the Bank of Canada and Bank of Japan, maintained their current stances.

U.S. Government

Due to the ongoing U.S. Government shutdown, access to certain economic and financial data has been temporarily restricted. Key reports—such as employment statistics, inflation updates, and other federal releases—may be delayed or unavailable until government operations resume. This data gap introduces uncertainty into market analysis and forecasting, as many investment decisions rely on timely and comprehensive economic indicators. While private and state-level sources may offer partial insights, the absence of federal data could affect short-term planning and risk assessments across the financial sector.

Trade relations showed signs of improvement during the month, particularly between the United States and China, where diplomatic progress helped ease tensions. Despite this positive momentum, global supply chains remain in flux, reflecting ongoing realignments and regional shifts in production and logistics. Geopolitical uncertainties—including conflicts, policy shifts, and regional instability—continue to pose risks to global commerce and investment flows.

Emerging markets were among the primary beneficiaries of the current environment, attracting capital inflows driven by favorable yield differentials and investor appetite for diversification. These markets continue to offer compelling opportunities, especially in regions with stable governance and improving economic fundamentals.

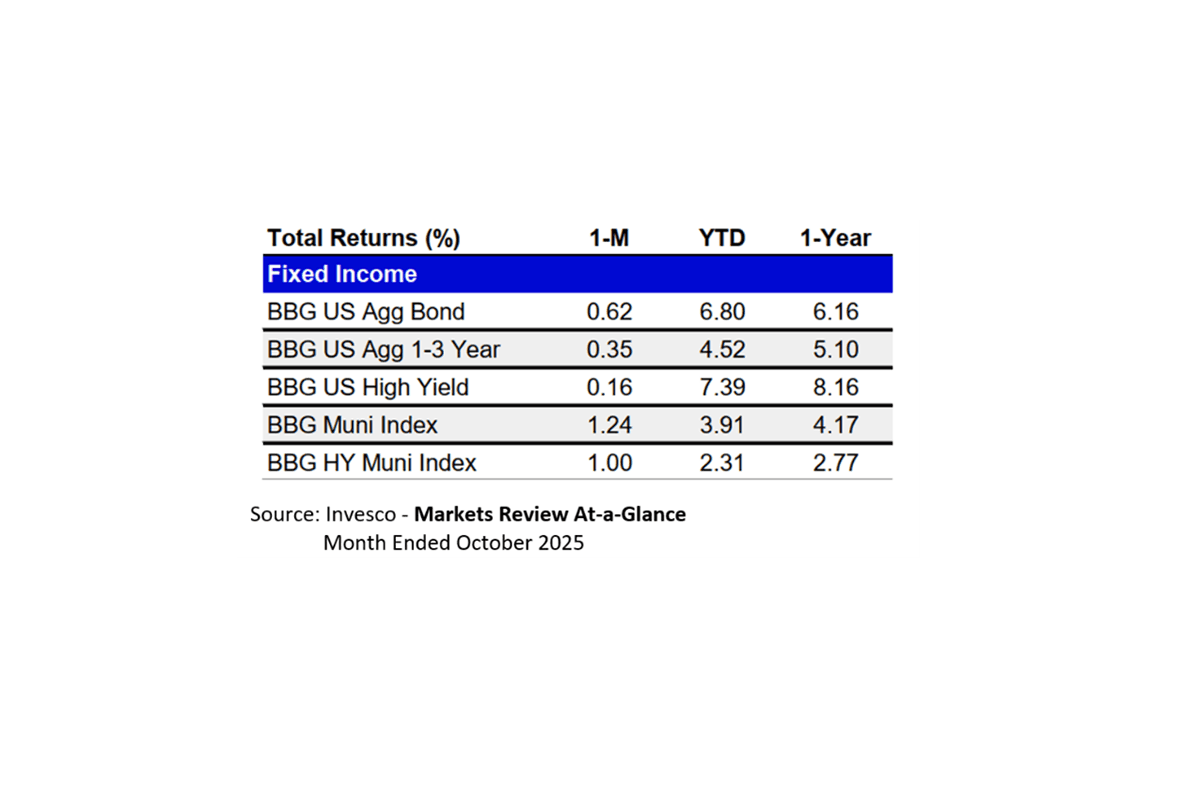

Bond markets rallied globally. U.S. Treasury yields declined, with the 10-year yield ending near 4.11%. Yield curves steepened, and municipal bonds posted strong returns. International bond yields underperformed domestic bonds. This comes after strong YTD performance in the international space.

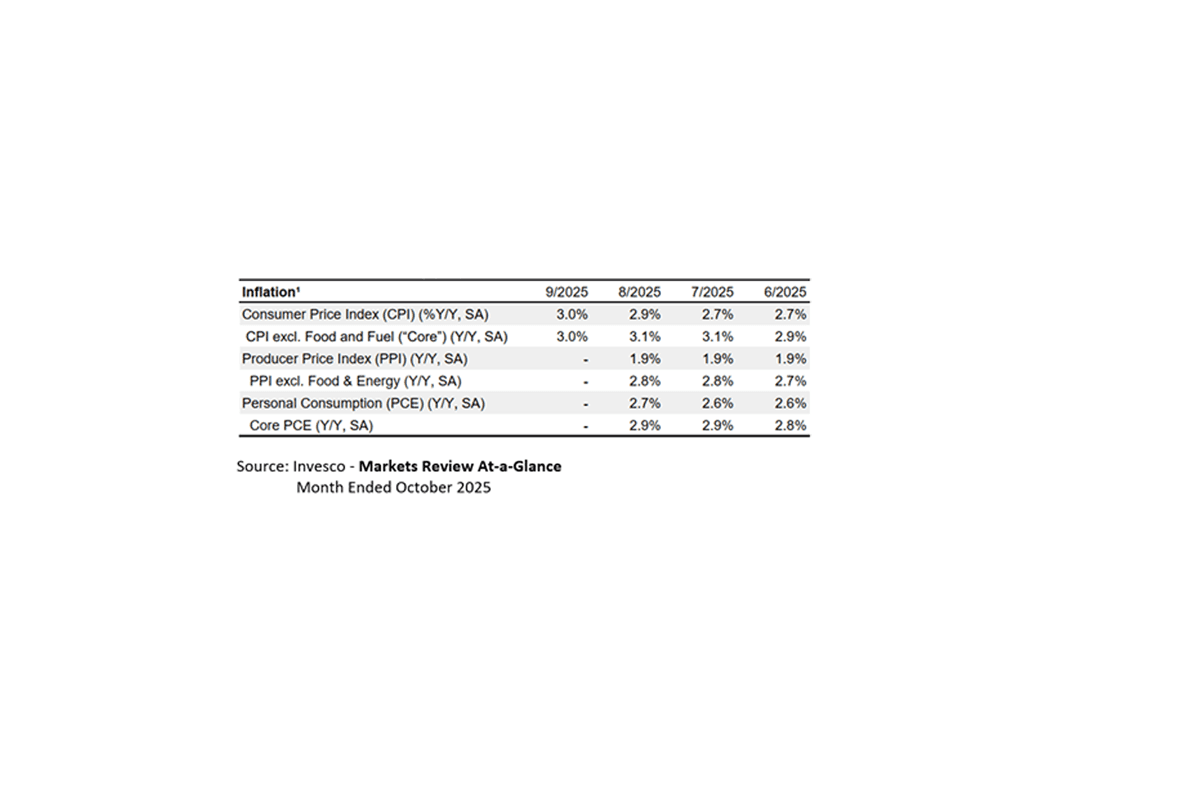

Inflation remained moderate. U.S. CPI rose 0.3% month-over-month, with core inflation at 3.0% year-over-year. The inflation rate from 1914 to 2025 averaged 3.29%, which is higher than the FOMC target rate. Based on the historical figures, inflation remains in check.

Due to the ongoing U.S. Government shutdown, access to certain economic and financial data has been temporarily restricted. Key reports—such as employment statistics, inflation updates, and other federal releases—may be delayed or unavailable until government operations resume. This data gap introduces uncertainty into market analysis and forecasting, as many investment decisions rely on timely and comprehensive economic indicators. While private and state-level sources may offer partial insights, the absence of federal data could affect short-term planning and risk assessments across the financial sector.

Trade relations showed signs of improvement during the month, particularly between the United States and China, where diplomatic progress helped ease tensions. Despite this positive momentum, global supply chains remain in flux, reflecting ongoing realignments and regional shifts in production and logistics. Geopolitical uncertainties—including conflicts, policy shifts, and regional instability—continue to pose risks to global commerce and investment flows.

Emerging markets were among the primary beneficiaries of the current environment, attracting capital inflows driven by favorable yield differentials and investor appetite for diversification. These markets continue to offer compelling opportunities, especially in regions with stable governance and improving economic fundamentals.

From a strategic standpoint, our investment approach remains anchored in diversification. We continue to emphasize a balanced allocation between growth and value equities, with increased attention to international exposure. Notably, our current portfolios are overweight international equities relative to historical norms, reflecting both valuation opportunities and broader macroeconomic positioning.

In the fixed income space, we are maintaining a bond duration that exceeds the benchmark index. This positioning is intentional, given the potential for further interest rate cuts and the current shape of the yield curve. With intermediate-term yields sitting below both short- and long-term rates—an inversion that distorts traditional duration strategies—our approach aims to capture more favorable returns while managing interest rate risk.

Why Stay Informed?

Staying informed about the latest economic trends and market movements is essential for making informed investment decisions. At Croghan Colonial Bank, we provide you with the insights you need to navigate these changes and optimize your investment strategy.

Important Legal Disclosures

*Investment products and services may lose value, are not a deposit, are not guaranteed by any financial institution, and are not FDIC insured or insured by any government agency.