Streamlined Solutions for Your Business

At Croghan Colonial Bank, we offer secure, convenient, and flexible digital services to help you manage your business finances. With 24/7 access and user-friendly features, you have the tools you need to make smart financial decisions, whether you’re handling payments, managing cash flow, or checking account details.

FAQS

How can I access Business Mobile Banking?

To use Business Mobile Banking, you must be enrolled in Business Online Banking. Once enrolled, download the Croghan Business Mobile Banking app from your device’s app store. Contact an Account Representative to receive and assign access.

What Merchant Services does Croghan offer?

Croghan provides services to accept credit and debit card payments, including wireless terminals and online employee access. You can also accept credit cards for online purchases from your website, and process mobile payments by converting your smartphone or tablet into a secure credit card terminal.

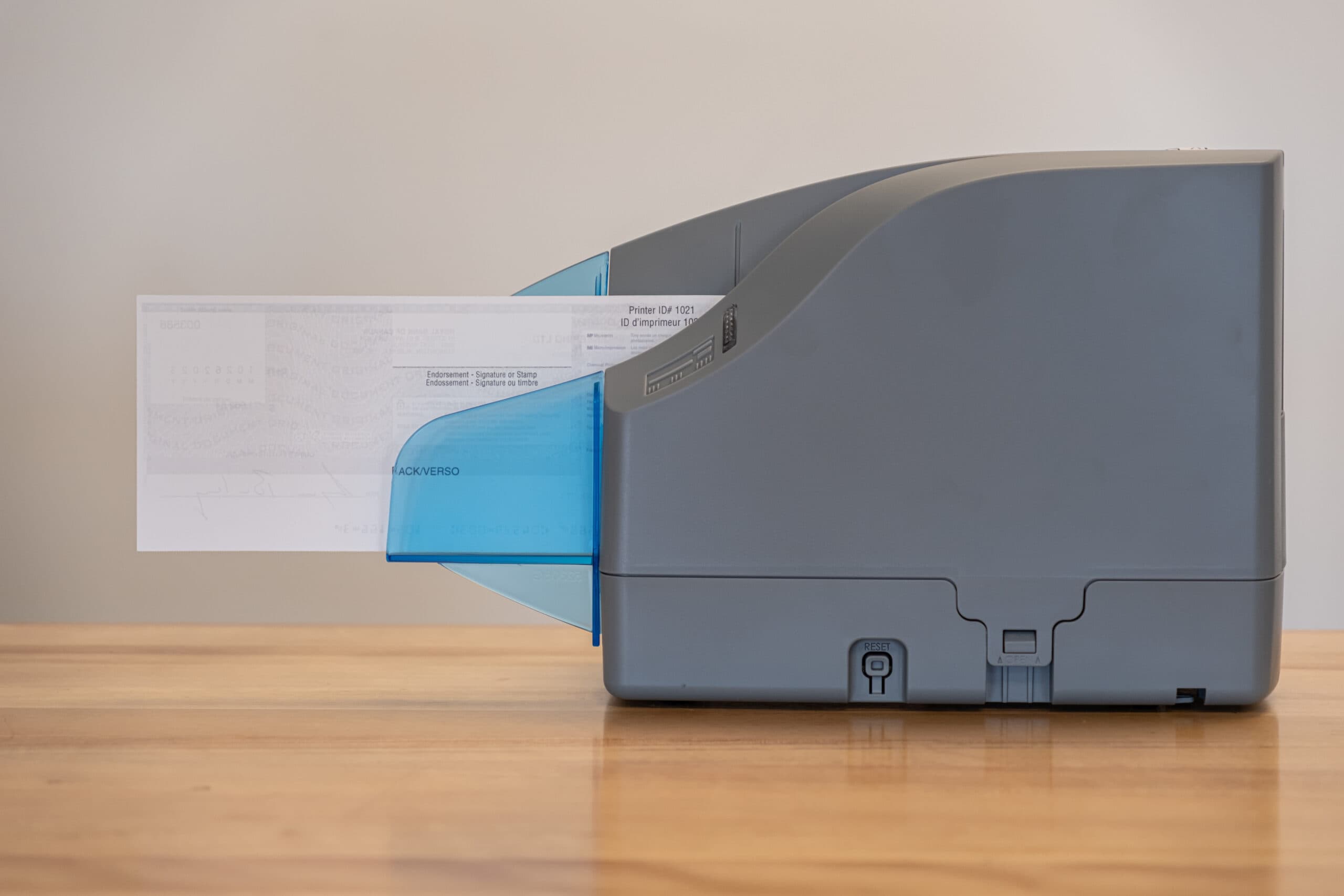

How does Merchant Capture work?

With Merchant Capture, you can deposit checks from your business using a scanner and your computer, eliminating trips to the bank. It allows for electronic check deposits anytime and also helps reduce the risk of check fraud.

What types of alerts can I set up for my business accounts?

You can set up real-time alerts for various categories, including ACH activity, ATM/Debit Card transactions, balance thresholds, certificate maturities, collateral activities, loan payments and statuses, security changes, transactions, transfers, and wire activities. Alerts can be received via text, email, or push notifications.

How should I endorse checks for Mobile Deposit?

Endorse checks with the following:

For Mobile Deposit / Today’s Date

Croghan Colonial Bank

Your Signature

Important Legal Disclosures

*Must be a Business Online Banking customer. Contact an Account Representative to receive and assign access.